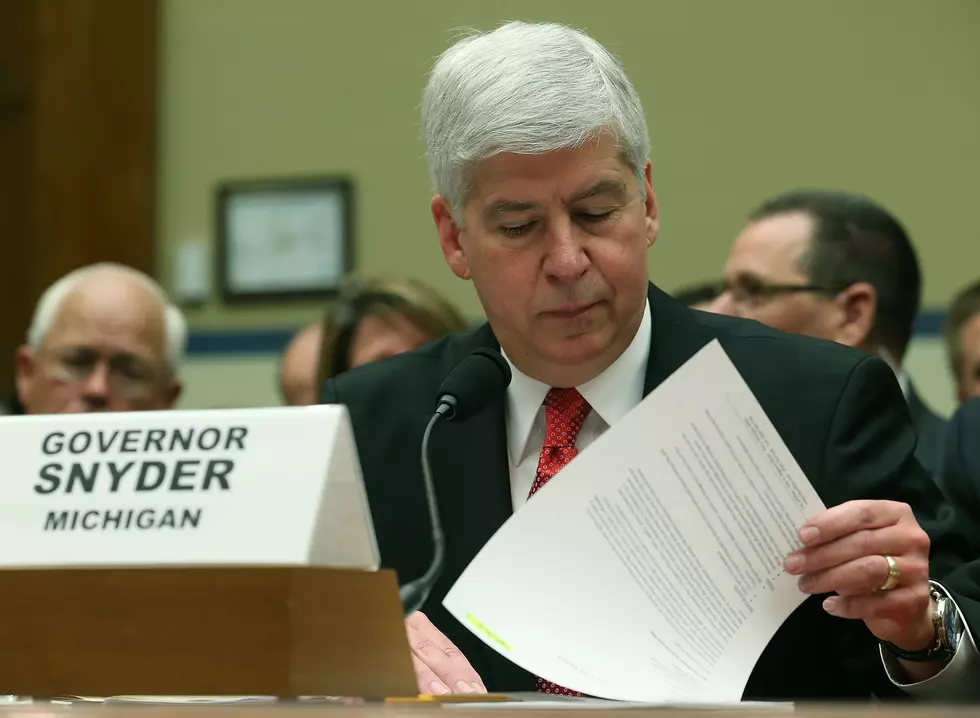

Michigan Supreme Court Gives Snyder Win in Taxing Pensions

The Michigan Supreme Court has ruled in the Governor's favor and will allow the taxing of pensions.

Snyder in response to the ruling saying he was "pleased" and that the administration has been "unwavering" that the removal of the exemption was "the right thing to do." Snyder added "it will provide for the long-term structural stability of the state's budget while minimizing the impact on current retirees and seniors. This will help get Michigan's fiscal house in order and economy back on track."

According to the Detroit Free Press, the new tax on pensions was expected to raise about $225 million in the first three quarters of 2012 and $343 million in the state's 2012-13 fiscal year. Those numbers will be reduced by about $60 million in 2012 and $90 million in 2013 because of the court's decision to strike down the phase-out of the personal exemption for wealthier taxpayers (those earning $75,000 and above for a single person, and $150,000 and above for couples).

More From WFNT

![Gov. Snyder, Help Flint Win the New Amazon Headquarters Bid [OPINION]](http://townsquare.media/site/47/files/2017/09/Snyder-WP.jpg?w=980&q=75)