Michigan House and Senate Approve Bills Affecting Sales Tax on Vehicle Purchases

The Michigan House and Senate have approved bills known as 'Sales Tax on the Difference' that will affect sales tax on vehicle purchases.

When an individual buys a new or used automobile or watercraft in Michigan, the state’s 6 percent sales tax is applied to the full sales price, even if the sale included a trade-in. Under the new legislation, the sales tax would be applied only to the difference between the price of a new or used car, boat or recreational vehicle and the value of a trade-in.

An example of the reform’s impact, once fully implemented, is that if a car valued at $5,000 is traded in and the owner applies the trade-in value toward the purchase of a $25,000 car, the sales tax would only be applied to the $20,000 difference.

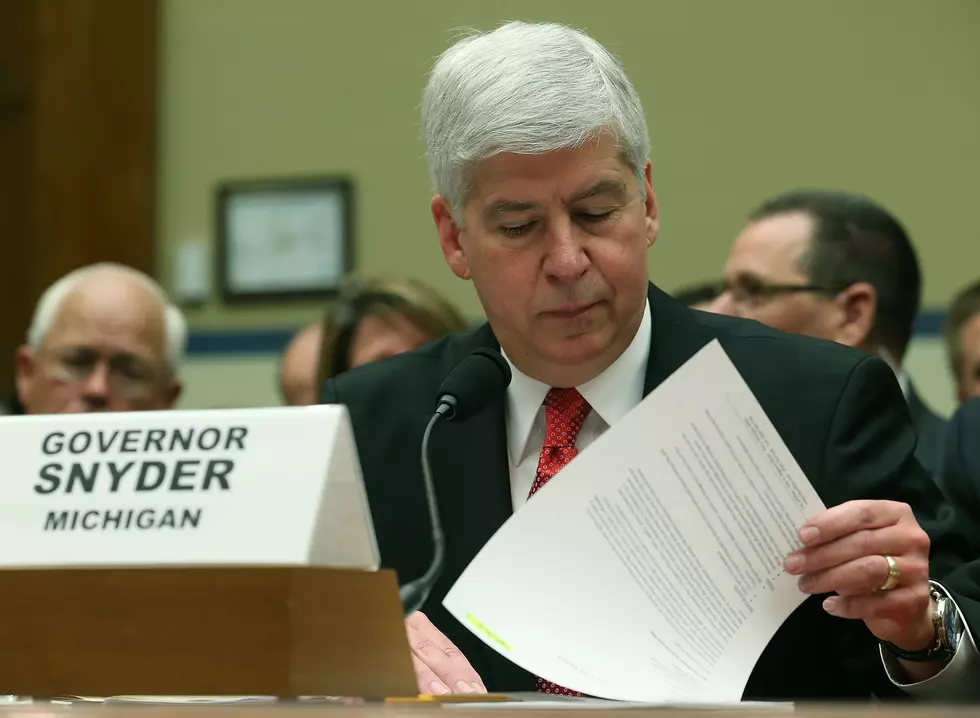

In a statement Governor Rick Snyder said the change "will bring needed relief to hard-working taxpayers while boosting Michigan's economy and maintaining the state's fiscal responsibility. The solution replaces and outdated system of having consumers being unfairly taxed twice for the same vehicle."

State Rep. Joe Graves (R- Argentine Twp) who championed the bill in the House said "the legislation should put a few dollars back into the pockets of Michigan families when they make a major purchase." Hear his comments below:

More From WFNT

![Gov. Snyder, Help Flint Win the New Amazon Headquarters Bid [OPINION]](http://townsquare.media/site/47/files/2017/09/Snyder-WP.jpg?w=980&q=75)